China revamping domestic capitalism

Over the previous weeks, the regulatory and political pressure has intensified on several sectors in China, which has contributed to the Chinese market correction initiated in February. This has dampened the equity story on China, which remains a secular conviction but weakened by short-term challenges.

Key developments this summer

In July, Chinese authorities have announced a decision to regulate more the domestic private education sector, specifically targeting curriculum-based education companies (AST or after school tutoring) which will now have to register as non-profit companies and cannot raise capital from the public. These companies will also be prevented from providing curriculum-based trainings on weekends and holidays; the guidelines issued by the CPCCC (Communist Party of China Central Committee) and State Council also prevent listed companies to invest in such companies.

These decisions are materialising a regulatory and political pressure that has been building on a USD100 billion sector, which President Xi Jinping was explicitly targeting on a speech delivered last May. From a market standpoint, AST companies had already lost 75% of their market value since February’s peak; but on 23 July, they lost, once more, over 50%, bringing the combined drop to circa 90% on TAL Education and New Oriental Education.

Some of these tutoring companies are currently considering their strategic alternatives and start taking measures, such as pivoting to non-curriculum based activities or simply cutting the cost base, as announced by Yuanfudao, a company back by Tencent, which plans to significantly reduce advertising and marketing costs. Despite these short-term measures, the restructuring implied by the new regulation looks immense and it is complex to assess if a price tag can be put on these companies, which are considered by many investors as non-investable.

Early August, President Xi Jinping has also decided to target the online gaming industry depicted as “spiritual opium”, in view of increasing addiction of minors, and this further weakened the position of technological stocks, which were already trading at a discount versus US peers. The decisions which consist in a limitation on the hours spent on gaming platforms by young people - and which have been tightened these last days to 3 hours per week - are not destroying the business model of Chinese tech giants but led to a revision of their revenue growth prospects.

Finally, in late August, Chinese authorities have extended the list of industries concerned by regulatory and political risk. A willingness to reduce social inequalities which had been accelerating in the last decade and sustain “common prosperity”, led to the announcement of an increase of taxation on wealthy households. The implications of that speech went beyond Chinese equities and affected the luxury sector, which lost more than 8% last week. It is possible that this willingness to reduce inequalities and address social needs could extend the pressure on additional sectors such as healthcare.

Market interpretation of recent decisions

Investors are witnessing this trend as a form of continuation and intensification of the regulatory crackdown initiated in late 2020 on the technology sector, which has suffered from numerous attacks (IPO cancelations, stronger antitrust pressure, intention to and willingness to control the use of data). However, the rationale of recent decisions is relatively new and connected with the social goal defined at the 100th anniversary of the Communist Party: the Chinese government wants to limit the social pressure on families and children, limit the money spent by households on after-school tuition, which could be one of the factors that explain the drop of birth rates. The intention is also to take back control and reaffirm the public nature of education, which, according to them, has been misguided from a common good to a capitalist industry. These decisions seem to fit in a puzzle of a more controlled version of Chinese capitalism, with a multiplication of rules on data security, anti-trust actions, intervention on the level of wages of food-delivery or on housing prices. While the Chinese government intention is not only about taking back control, it also reflects a willingness to shape a different balance between social objectives and private interests.

This also comes in a broader context marked by the growing pressure from the US against Chinese technology companies. Indeed, the Security and Exchange Commission (SEC) has indicated that China-based companies will now have to provide more transparency on their structure and relations with the Chinese government to obtain a listing on the US markets. Disclosure requirements follow a recent decision from the Chinese authorities regarding overseas listings of Chinese firms and notably rules regarding the use of data in the hands of these companies.

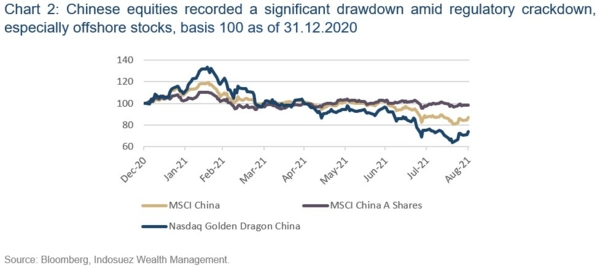

After a difficult summer, investors are now trying to ponder the regulatory shift on these sectors as well as softer macro data (slight disappointment on July PMIs) with the attractive valuations now offered by Chinese equities after a significant drawdown. Indeed, MSCI China is now at -21% YTD and -32% versus February peak (see chart 2). Past weeks have drawn Chinese equities in what is usually described as an oversold territory (RSI index below 30) from a technical standpoint, and are offering an interesting entry point as the valuation gap with US equities is wider every day. Indeed, the S&P 500 trades at 27x at 12M earnings versus 17x for the index of domestic Chinese stocks (CSI 300). It is important to remind here that most leading Chinese internet leaders have published very strong earnings in the second quarter, above market expectations (see chart 3).

Impact on our scenario and long-term convictions on Chinese assets

Before the regulatory crackdown and softening of Chinese economics, our constructive view on Chinese equities was relying on the following pillars:

- Strong and secular revenue and earnings growth prospects fuelled by a higher GDP growth and by secular trends (rising middle class, R&D, higher penetration of financial services and healthcare);

- Dominant positions of Chinese corporates in many innovative industries, sustained by a huge domestic market difficult to penetrate for foreign companies and by a stronger R&D effort;

- Greater integration of Chinese equities in international indices driving structural positive flows;

- Pro-business attitude of authorities with a strong track record in policy mix in the past years;

- Better growth / valuation mix than in many developed markets;

- More stable currency than in other emerging markets, with credible central bank.

Several of these elements are still true today, in particular the long-term GDP growth prospect, the international inclusion in MSCI indices, the policy mix track record, and currency strength. What has changed is the nature of balance capitalism and regulation, with a reset of equilibrium between the interests of big groups and the social welfare, as well as state control. Meanwhile, the earnings momentum lags the one of US and European equities this year, and this is reinforced by the positive revisions on developed equities in view of a strong Q2 earnings season; this remains one of the weak points of the Chinese markets this year in comparison with mature equity markets of western countries and after two stunning years. Besides, in the recent months, the macroeconomic momentum has soften significantly.

We do not feel that this the end of capitalism in China but we consider this summer as a turnaround in the market philosophy of Chinese authorities that one should not underestimate. All these decisions are probably favouring a better allocation of resources and could sustain the potential growth of the Chinese economy in the longer run. In the short term, it logically leads to a reassessment of the valuation of many companies, even if the recent market trend resembles more to a global capitulation from foreign investors reallocating to US equities. These decisions do not jeopardize the long-term equity story, but are affecting the visibility and short-term growth prospect, which have affected international flows. Regarding foreign listing of Chinese companies, even if the long term goal is probably to have Chinese companies listing domestically we do not think that recent US/China issues on this matter mean the end of foreign listings: China will continue to allow (but control) foreign listing, and should find an agreement with the US on the disclosure expectations.

Therefore, uncertainty level remain a form of roadblock for international flow to come back and make China a challenging call in the short term, as this regulatory tightening cycle may not be over. For flows to come back, we would need to see either a strong catalyst coming either from the macroeconomic sphere, from the earnings momentum or from a softer stance from public authorities.

To sum up, China should remain a strategic conviction in a long-term portfolio benefiting from secular growth drivers that have not evaporated in the summer heat. Tactically, the asymmetry should be increasingly positive for investors after the significant pullback we have experienced, but the macro and micro fundamentals as well as political uncertainties could continue to weigh on investors sentiment. In this context, investors should keep their existing exposure but could diversify their sector exposure to industries less vulnerable to regulatory pressure and more aligned with government priorities (such as renewable energy). Investors not yet exposed to Chinese assets could build exposure progressively as it will become increasingly difficult to stay away from the largest economy in the world which is still underrepresented in international indices and portfolios.

September 01, 2021