Omicron weighing on investor sentiment

1. The Omicron Variant: key facts so far

- This time, Black Friday deserves his acronym. A panic occurred on markets on Friday following the identification of a new variant in South Africa, with cases of this new variant called Omicron have already been identified in several countries in Europe and Asia;

- Omicron is expected to be more contagious and more resistant to current vaccines than previous variants. According to the Medical association of South Africa, symptoms are described as relatively mild so far. Nevertheless, cautiousness still prevails, according to the World Health Organization; this attitude is justified given that we know little so far and given a potentially higher reinfection risk;

- This new catalyst comes in a context where the pre-existing variant delta has already caused a wave of new cases in Europe despite elevated vaccination rates, amplifying the fear reaction on Friday.

2. Travel restrictions are back

- Japan has reintroduced work restrictions and has banned entrance to foreign visitors and Israel closed its borders to all inbound foreign national for 14 days;

- In Europe, the UK has reintroduced mandatory PCR tests, while Spain and Switzerland have tightened access for arrivals from Britain. Meanwhile other countries are considering reimplementing travel restrictions.

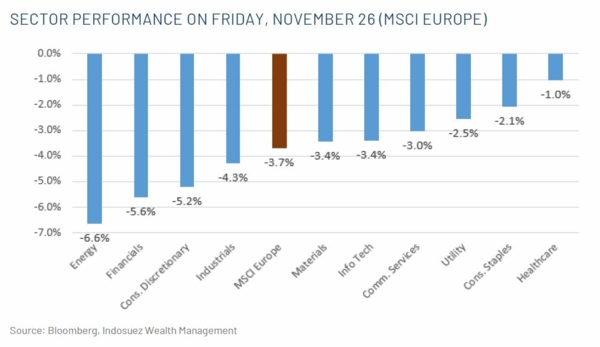

3. Market reaction: a volatility event during Thanksgiving Weekend

- The discovery of this new variant has led to a liquidity and volatility shock on Friday with European equities down by close to 5%, while a more muted reaction was seen on the US markets, which were down by approximately 2% in a market with limited volumes after Thanksgiving;

- The reversal of reopening trade, on profit taking on a 7-week uninterrupted rally since earlier October;

- Airlines and hotel & leisure sectors market reaction as well as a more than 10% drop of oil prices are a clear reflection of that turmoil;

- This correction takes us back to early October levels on European markets, but only 2% below all-time highs recently reached on US markets;

- Equity markets seem to stabilise this Monday morning, with Japan down by only 1% and European markets in positive territory;

- Beyond equities, we have witnessed a rush into government bonds and a compression of the US yield curve, which implicitly cancels close to one of the almost three rate hikes markets were expecting for 2022;

- On the forex markets, the Yen and CHF were sustained as traditional safe havens, while the US dollar corrected slightly against the euro, probably reflecting an overdone movement lately and the current adjustment of rate hike expectations.

4. Impact on the scenario

- This new variant should probably soften the economic activity in December and the beginning of 2022 and notably trade and tourism;

- Investors will also question the impact on inflation and central bank policy as the occasion of the upcoming Fed, ECB and BoE policy meetings in mid-December:

- More broadly speaking, this is another uncertainty factor in a complex and bumpy recovery process initiated in Summer 2020, but we do not anticipate countries implementing a global lockdown;

- The investment themes attached to the reopening of the economy may underperform in the short term;

- At this stage, and with all the cautiousness attached to the little information received so far, we do not view this event as a game changer to the scenario at this stage that would justify reducing risks significantly. Investors may exploit this volatility event to use existing cash levels and rebuild positions;

- The risk factors surrounding our view relate to the risk of escalating measures of travel restrictions, and further developments on the nature of the variant and the vaccine efficiency against it.

5- Next steps

- This week, beyond the newsflow developments on the variant, investors will follow the OPEC+ meeting taking place on Wednesday as well as the US non-farm payrolls on Friday;

- They will also look at Euro Area inflation data and at the November surveys on manufacturing and services in China, Europe and in the US.

November 29, 2021