UK: the confidence crisis

Investors appear to have lost confidence in the UK. The market sell off on Friday the 23 September was brutal and followed by an IMF alert on the government's costly support plan. Lack of clarity in policy coordination and a relatively worse-off macro-economic situation are to blame. The Bank of England (BoE) has its work cut out: bring down inflation while also maintaining sufficient liquidity in the bond market as the UK’s financing needs have now significantly increased. Excessive use of the fiscal arm can indeed backfire.

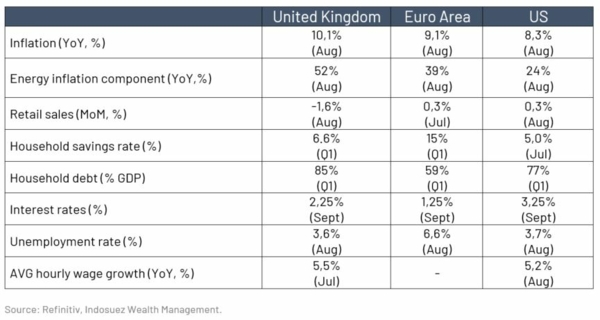

UK economic outlook: worse compared to Euro Area and the US

The situation for households is indeed grim (Table 1). The jobs market is still strong, but wage growth is below inflation. Consumer confidence is well below the 2008 level, while household balance sheets are not as robust with less social buffers than in Europe. UK mortgage rates are predominantly short fixed term (generally adjusting after 5 years), a rising interest payment burden will exert additional strain on households’ disposable income and spending.

Energy consumer price inflation was up 52% YoY in August in the UK (albeit it down from 59% in July). This mainly stems from price rises for gas and electricity following the increase in the Office of Gas and Electricity Markets (Ofgem) cap on energy prices on 1 April 2022, and follows an earlier rise in the price cap on 1 October 2021. Although the UK benefits from domestic production of oil and natural gas, and depends little on Russia for gas, it relies more on gas than most of its European peers and does not have as much capacity to store gas, forcing it to buy on the short-term spot market with greater volatility in prices.

Table 1: macro data: uk vs. Peers

New stimulus to limit the recession

The UK government has announced two batches of new stimulus to bolster the economy:

- On the 8 September the new British government announced a massive energy support package (estimated at GBP 150 billion, 6% of GDP) in response to strong public unrest triggered by the cost of living crisis. The Energy Price Guarantee (EPG) was introduced to cap energy prices for households for two years at 2’500 GBP from October 2022 compared to the planned rise to 3’550 GBP (and 5’390 GBP by April 2023).

- Two weeks later, on the 23 September the finance minister announced 45 billion (approximately 2% GDP) in additional measures of tax cuts (notably cancelation in the rise in the corporate tax).

As a result, the BoE expects the EPG to reduce inflation: seeing the peak of inflation at 11% in October (instead of 13% in January 2023). Nevertheless, the resulting sell off in the GBP will also increase imported inflation, notably in food.

We remain prudent on increasing our GDP growth forecasts for this reason (currently at -0.5% in 2023 after 3.4% growth in 2022 mainly driven by a strong carry-over effect from 2021). As underlined by the BoE, the UK will enter recession in Q3 as an energy bill at 2’500 GBP still represents an over 25% rise of the cap (from 1’971 GBP today). In addition, both services and manufacturing PMI are now under the 50-mark threshold as of September and consumer confidence continues to plunge, well below the 2008 financial crisis level. The BoE now expects GDP to fall by 0.1% in Q3 (below the August Report projection of 0.4%). There may be silver lining for long term growth as the new government bares promises to de-regulate swathes of the economy, but in the short term the outlook remains very challenging despite the new stimulus measures.

Finally, the National Institute of Economic and Social research (NIES) estimated the UK deficit would reach 8% of GDP in 2022 (after 7.9% in 2021). This also implies higher financing needs (estimated at GBP 170 billion in 18 months) for the UK government.

Market frictions and BoE responsiveness

Investors appear to have lost confidence in the UK. The sterling was the hardest hit, falling below the 1.10 mark against the USD (at 1.08 on 28.09.2022). The UK bond market was equally hit, with the 10-year Gilt increasing to 4.5% on the morning of the 28.09.2022 and 30-year bond yields clearly surpassing 2-year rates (Chart 1). The BoE was forced into action: temporarily purchasing targeted Gilts to tackle a “specific problem in the long-dated government bond market”. After the BoE’s moves, the 30-year closed 115 basis points below its opening rate and the 10 year receded to 4% at the end of the session. Nevertheless, uncertainty remains high and bond rates volatile.

In addition, the BoE’s initial plans to go into QT mode (quantitative tightening) and release 70 billion GBP worth of UK bonds into the market, have been postponed from the 3 October until the 31 October. Although this has significantly lowered rates and avoided a stress for UK pensioners, the impact on the GBP has been muted, with a still unfavourable interest rate differential with the hawkish Fed (Table 1).

All in all, markets now expect the BoE to raise rates to 4.6% by end 2022 and 5.7% in August 2023.

Chart 1: correction in UK Gilt bond rates before & after BoE intervention, %

What should investors look out for in this period?

- The GBP still has room to fall in the current context; we would need to see some signs of improvement in the economic situation, tamer inflation and a better US interest rate differential before the currency can bottom out.

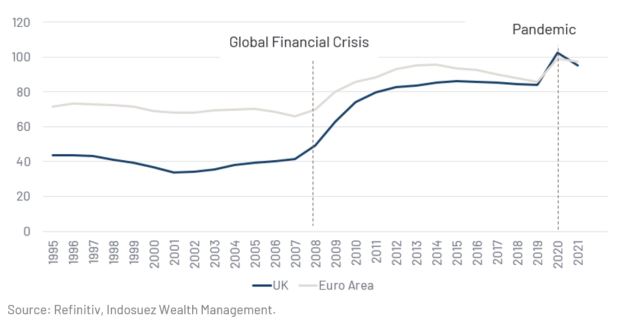

- The fact that the stock market did not react positively to the new stimulus package proves that the market is not buy the fiscal band-aid when it comes to inflation. Fiscal policy is not a magic wand. Even if inflation mechanically reduces the debt-to-nominal GDP ratio, markets remain cautious given that both the UK, along with the Euro Area, have not been able to significantly reduce their indebtedness since the 2008-2009 financial crisis (Chart 2). Fiscal sustainability may yet return as a key theme for markets in 2023/2024.

- In this very volatile environment, we remain underweight on UK equities. UK equities have resisted better in the first half of the year thanks to a stronger exposure to energy and commodities sectors. Furthermore, even if 70% of FTSE 100 sales are done outside the UK and could translate into stronger Q3 numbers in GBP, the weakening of the sentiment on the British economy and currency should keep investors away from this market in the next quarter. Indeed, in the past days, the negative correlation between the currency and the equity market has broken. Tactically the market could respond positively to the BoE announcement on Gilt purchases, but overall, flows should remain fragile in this context.

Chart 2: UK governement debt trajectory, % GDP

September 29, 2022